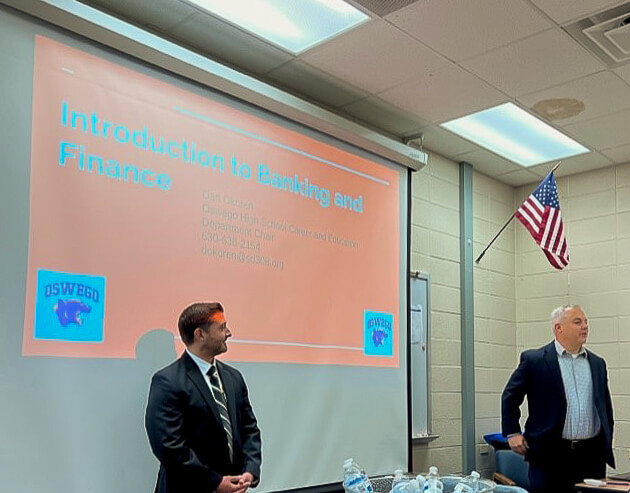

“This is a learning first program” are some of the first words shared by Business Teacher Tim Taviani as he welcomed a room of Illinois Work-Based Learning Innovation Network (I-WIN) partners to the Panther Credit Union, a banking and finance work-based learning opportunity made possible through the partnership of Oswego High School, Earthmover Credit Union, and the Valley Education for Employment System work-based learning committee. Throughout the day—I-WIN’s first in-person event—the emphasis on student learning, mentorship, and support from both the school and industry partners were evident in all the resources and insights that were shared.

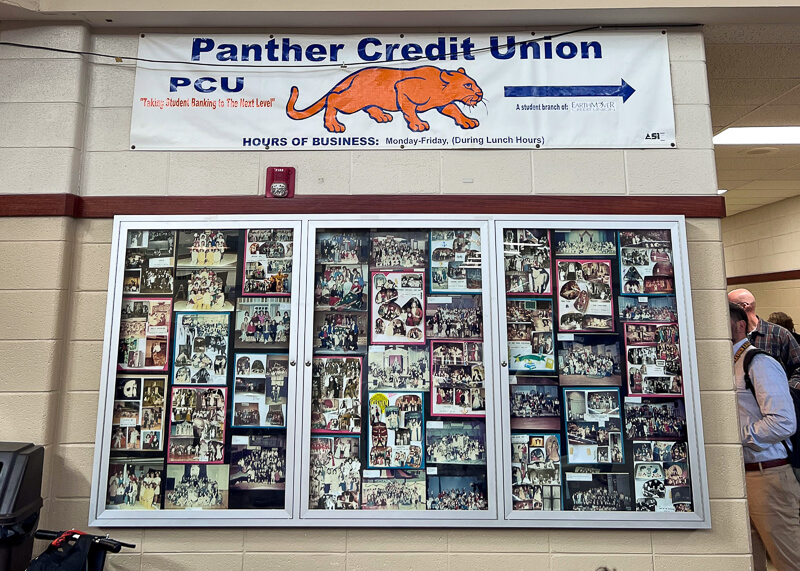

At Oswego High School, the Panther Credit Union is redefining education by providing students with hands-on experience in the financial world. The non-profit is an on-campus student-run branch of Earthmover Credit Union. This innovative career development experience, which has been evolving for nearly three decades, offers an extraordinary opportunity for high school students to gain insights into the intricacies of banking, finance, and personal life management. Students complete a 1.5 credit course in which they address requirements for consumer education and learn about essential employability skills, complete a financial curriculum provided by Earthmover, and work 3-4 hours per week.

A Long-Standing Tradition of Learning

The Panther Credit Union was established in 1996 and, in the past 27 years, has seen significant changes in the banking landscape. Initially, it focused on building skills to address drive-up banking needs, but it has since evolved to emphasize marketing.

Tim works closely with Katie Haynes, the current mentor and branch coordinator from Earthmover, to collaborate on the curriculum and activities students engage in throughout the year. When Katie is not at Panther Credit Union, she works as a personal banker at Earthmover, setting annual account goals for students. Due to the sensitive nature of financial transactions, the program emphasizes building trust and buy-in among students, teachers, and the employer mentor. Tim and Katie shared that this trust is the most important piece of keeping an experience like this successful.

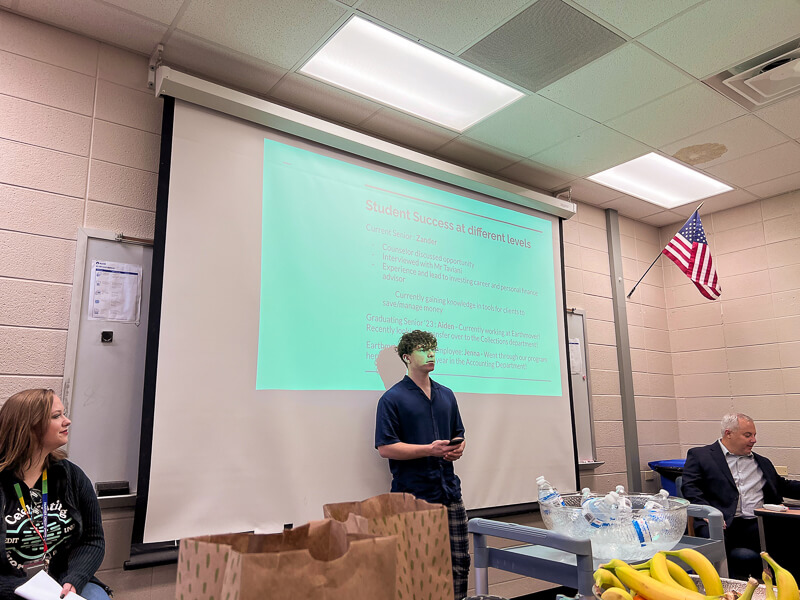

Assessment in the program is unique and meant to support the fact that for many of the students in the career development experience, this is their first job. Students are judged primarily on their learning, with expectations of deliverables as a regular employee coming second. The essential employability skills of teamwork, communication, customer service, and accountability are emphasized throughout the year in both the classroom and on-site at the Panther Credit Union.

The credit union operates during lunch hours, providing students with a convenient opportunity to manage their banking needs. Student workers are paid at minimum wage, currently $13 an hour. They work 3-4 hours per week, either performing transactions or marketing the program to their fellow students in the lunchroom and classrooms. For more details on the model, download the Panther Credit Union overview.

Support Beyond the Classroom Teacher

A common work-based learning barrier is addressing the competition in scheduling to include all of the courses and activities students participate in. Oswego High School understands the importance of flexibility in its students’ education and the need to navigate the challenge of balancing work hours at the Panther Credit Union with students’ interests, ensuring they can explore other classes of their choice. School counselors are highly aware of the program and play a pivotal role in this process to accommodate the double block of the credit union class.

Another challenge to work-based learning is administrative support beyond the sometimes single staff member who advocates for work-based learning. For the credit union program, the teacher dedicated to this class has no other duties, allowing them to check in daily with students and the Earthmover mentor. This provides protected time for the teacher and employer mentor to collaborate and support students.

Collaborative School and Industry Partnership

The unwavering support of Earthmover has been integral in shaping the Panther Credit Union program. In addition to providing an employee as an on-site mentor, Earthmover supported the renovation of a bathroom into the physical space where the non-profit is now housed. Both Katie and Tim expressed that a good employer exhibits several key characteristics, including flexibility, patience, understanding the need for second chances with students, and the recognition that they are still learning.

Students apply during their junior year of high school and are interviewed by Tim, who shares hiring recommendations with Earthmover. In the past, Earthmover has not been a part of these interviews, but they are looking to engage more directly in the interview process moving forward to provide students with an even more robust learning opportunity.

While Tim leads the classroom curriculum for banking and finance, Katie guides students through a financial literacy curriculum and onboarding aligned with the same content that Earthmover employees are expected to complete. Katie also sets annual goals for students, such as opening 50 new accounts for the school year. Tim and Katie collaborate throughout the year to ensure there are no surprises regarding student grades. Students receive two grades in the course: one for the class from Tim and one for their work from “their boss” Katie. Students are provided a mid-point benchmark grade each semester, giving students insight into their performance and opportunities to improve.

The Impact of Panther Credit Union

The Panther Credit Union program has a significant impact on its students. One student shared that it has helped them pursue a career as a personal finance director, allowing them to manage finances for themselves and others effectively. Many students who have participated in the career development experience continue to work part-time at Earthmover after high school, and the current VP of Marketing at Earthmover is a Panther Credit Union alum.

The Panther Credit Union is an innovative example of how real-world experience can enhance education. It equips students with not just theoretical knowledge but also practical skills they can carry with them into the future. Through a unique partnership with Earthmover Credit Union and a dedicated teaching staff, this program is shaping the lives and careers of students, one financial transaction at a time.